10 Powerful Tips On What Business Expenses Are Tax Deductible So You Pay Less Tax

What business expenses are tax deductible is one of the most important financial questions every entrepreneur, freelancer, and business owner must understand. Knowing what business expenses are tax deductible helps you legally reduce your taxable income without risking penalties or audits.

Many businesses pay more tax than necessary simply because they do not fully understand allowed deductions or fail to document them properly. By learning what business expenses are tax deductible, you begin to recognize which day to day costs support your business operations and therefore may qualify for tax relief.

This article explains clearly and professionally what business expenses are tax deductible, how the rules generally work, and which mistakes you should avoid so you stay compliant while maximizing your legitimate savings.

1. Understanding The Basic Principle Behind Tax Deductible Expenses

A key starting point for understanding what business expenses are tax deductible is recognizing that an expense must be both “ordinary and necessary” for your trade or profession. “Ordinary” means it is common and accepted in your industry, while “necessary” means it is helpful and appropriate for running your business.

Personal expenses rarely qualify, even if they indirectly relate to your work. When in doubt, ask whether the cost exists primarily to support business operations. This core definition guides governments and tax authorities when deciding what business expenses are tax deductible for companies of all sizes.

2. Office Expenses And Workspace Costs

Office costs form one of the largest categories in what business expenses are tax deductible, including rent, utilities, office supplies, software, and maintenance for business premises. Business owners who work from home may also qualify for the home office deduction when a dedicated workspace is used exclusively for business.

The portion of internet, electricity, and phone services linked to business activity can also be included. Accurate allocation is essential to avoid overstating deductions. These costs are often straightforward examples of what business expenses are tax deductible when properly documented.

3. Travel And Transportation Expenses

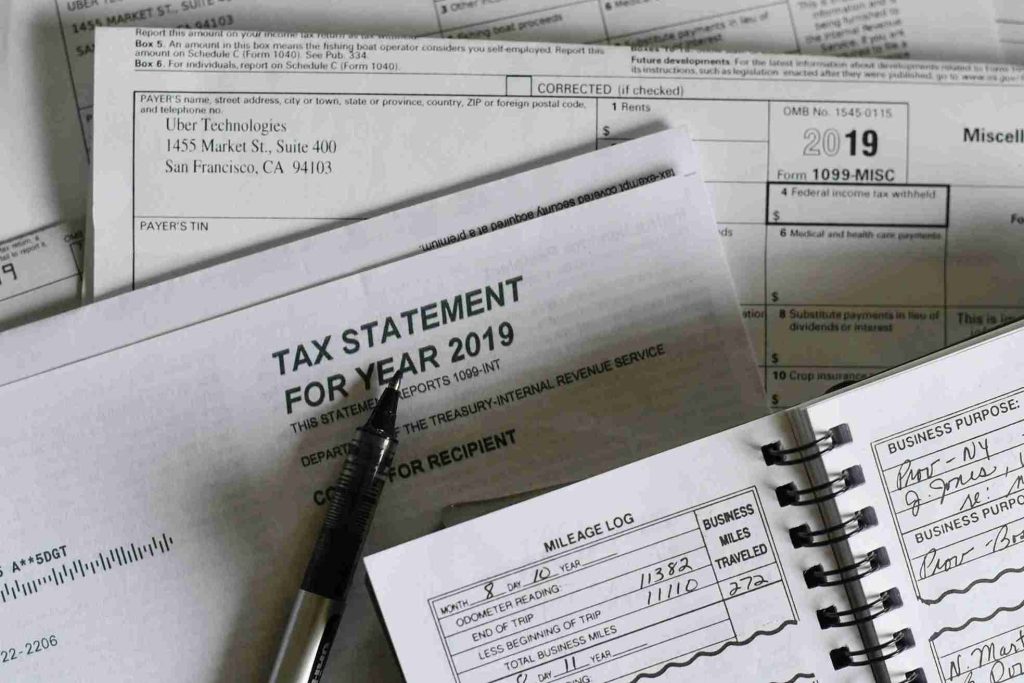

Travel spending is another major area within what business expenses are tax deductible, covering airfare, hotels, fuel, public transportation, mileage, and meals while traveling for work. The key requirement is that the trip must have a clear business purpose, such as client meetings, industry conferences, or training.

Commuting between home and a regular workplace usually does not qualify. Keeping logs and receipts strengthens your claim and protects you during audits. Correct travel record keeping ensures you capture what business expenses are tax deductible without crossing compliance boundaries.

4. Advertising, Marketing, And Promotion Costs

Marketing and promotional spending fit naturally into what business expenses are tax deductible, because they directly support revenue generation and brand awareness. Examples include website hosting, paid ads, social media promotion, brochures, events, and professional branding services.

These costs are often overlooked by small businesses that do not treat marketing as a formal budget category. A clear marketing strategy supported by receipts and invoices protects your deduction claims. Understanding that promotional investment counts toward what business expenses are tax deductible encourages smarter long term growth planning.

5. Professional Services And Outsourced Expertise

Payments to accountants, consultants, lawyers, tax advisors, IT specialists, and freelancers fall under what business expenses are tax deductible when their services relate to business operations.

These professionals help you manage risk, improve performance, and maintain compliance. Their fees are classified as operating expenses rather than personal consumption.

Maintaining contracts and proof of payment ensures clarity for tax authorities. Recognizing that professional fees are part of what business expenses are tax deductible allows you to seek expert help without fearing unnecessary tax exposure.

6. Employee Wages, Benefits, And Contractor Payments

Labor costs represent a major component of what business expenses are tax deductible, including salaries, bonuses, commissions, benefits, pension contributions, and certain training programs.

Payments to independent contractors also qualify when work is business related and properly recorded. Compliance with employment and reporting regulations remains critical.

Deductibility does not remove the need to issue correct documentation such as year-end income statements where applicable. Understanding that human capital is part of what business expenses are tax deductible highlights the link between workforce investment and financial efficiency.

7. Depreciation And Business Asset Purchases

Large business assets do not always qualify as immediate deductions, but they still fall within what business expenses are tax deductible through depreciation or accelerated expense rules.

This applies to equipment, vehicles, furniture, computers, and certain property improvements. Depreciation spreads the cost across the useful life of the asset, matching expense recognition with operational benefit.

Tax authorities often provide specific schedules and categories. Learning how depreciation fits into what business expenses are tax deductible helps you plan investments in a structured, compliant manner.

8. Insurance Premiums And Risk Protection Costs

Insurance premiums directly related to business operations also form part of what business expenses are tax deductible, such as liability insurance, property insurance, professional indemnity coverage, cyber insurance, or key person insurance.

Health insurance premiums for employees may also qualify depending on jurisdiction. These costs protect the business against unexpected risk, making them operational rather than personal.

Documenting policies and payment dates is important for audit proofing. Including insurance within what business expenses are tax deductible reinforces the value of proactive risk management.

9. Education, Training, And Skill Development

Training expenses qualify under what business expenses are tax deductible when they maintain or improve skills necessary for your current business activities. These include workshops, certifications, industry courses, conferences, and educational materials.

Education aimed purely at entering a new profession generally does not qualify. Travel linked to approved training may also be deductible.

Continuous learning is therefore both a strategic investment and part of what business expenses are tax deductible when aligned with your existing operations.

10. Software, Technology, And Digital Tools

Technology costs now represent a significant portion of what business expenses are tax deductible, including cloud subscriptions, cybersecurity tools, accounting platforms, CRM systems, project management software, and data storage services.

Hardware purchases may fall under depreciation rules, while subscriptions and licensing fees usually qualify as ongoing operational expenses.

Accurate classification ensures compliance with financial reporting standards. Recognizing digital infrastructure as part of what business expenses are tax deductible reflects the realities of modern business environments.

Important Rules To Remember About Deductible Expenses

To correctly apply what business expenses are tax deductible, strong record keeping is essential. Receipts, contracts, bank statements, mileage logs, and digital invoices help create a full audit trail. Mixing personal and business expenses in the same account increases the risk of mistakes and disallowed claims.

Seeking professional advice also helps you interpret complex rules such as partial use of assets, home office calculations, and depreciation schedules. A disciplined approach ensures you claim what business expenses are tax deductible with confidence rather than uncertainty.

Common Mistakes That Lead To Rejected Deductions

Many businesses misunderstand what business expenses are tax deductible and lose eligibility due to poor documentation, excessive personal use of business assets, or claiming non-qualifying lifestyle costs. Overclaiming meals, unverified travel, or entertainment unrelated to business can trigger scrutiny.

Another frequent error is claiming capital purchases incorrectly as immediate deductible expenses rather than depreciable assets. Understanding the difference between personal, mixed use, and purely business expenses is vital. Avoiding these mistakes protects your right to claim what business expenses are tax deductible legitimately.

Conclusion

Understanding what business expenses are tax deductible is a strategic financial skill rather than simply a tax filing task. When you clearly distinguish business spending from personal consumption and maintain accurate records, you lower taxable income while staying compliant with regulatory expectations.

Each of the categories discussed above demonstrates how operational costs support profitability and therefore qualify for relief when used responsibly. Treating taxation as part of overall financial planning helps you reinvest more capital into innovation, hiring, and long term growth.

With expert guidance, disciplined bookkeeping, and awareness of what business expenses are tax deductible, you can manage your obligations confidently while maximizing legal tax efficiency year after year.

Read more: 10 Common Reasons Why Business Fail And How You Can Avoid Them